The Basic Principles Of Clark Wealth Partners

Table of ContentsWhat Does Clark Wealth Partners Do?The Best Strategy To Use For Clark Wealth PartnersThe Best Guide To Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneNot known Details About Clark Wealth Partners The smart Trick of Clark Wealth Partners That Nobody is Talking AboutThe 2-Minute Rule for Clark Wealth Partners7 Simple Techniques For Clark Wealth Partners

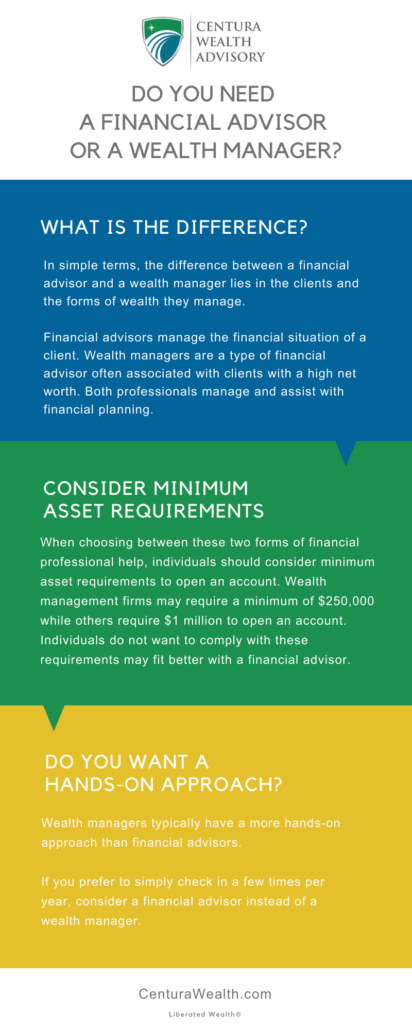

Typical reasons to think about an economic advisor are: If your economic scenario has actually ended up being much more intricate, or you lack confidence in your money-managing abilities. Saving or navigating significant life events like marital relationship, divorce, kids, inheritance, or work adjustment that might significantly affect your financial circumstance. Navigating the transition from saving for retirement to protecting riches during retired life and exactly how to create a strong retired life earnings strategy.New technology has actually resulted in more comprehensive automated monetary tools, like robo-advisors. It's up to you to explore and determine the right fit - https://www.huntingnet.com/forum/members/clrkwlthprtnr.html. Inevitably, an excellent monetary expert ought to be as mindful of your financial investments as they are with their own, avoiding excessive charges, conserving money on taxes, and being as clear as feasible regarding your gains and losses

Clark Wealth Partners Fundamentals Explained

Making a commission on item referrals does not necessarily mean your fee-based advisor functions against your best rate of interests. They may be more inclined to recommend products and services on which they gain a payment, which might or may not be in your ideal rate of interest. A fiduciary is legally bound to put their client's interests.

This common allows them to make referrals for financial investments and solutions as long as they fit their client's goals, risk tolerance, and economic situation. On the other hand, fiduciary advisors are legitimately obliged to act in their client's best rate of interest rather than their own.

Everything about Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving right into complicated economic subjects, dropping light on lesser-known investment opportunities, and revealing means visitors can work the system to their benefit. As an individual financing expert in her 20s, Tessa is acutely knowledgeable about the impacts time and uncertainty have on your financial investment decisions.

It was a targeted promotion, and it functioned. Find out more Read much less.

The Ultimate Guide To Clark Wealth Partners

There's no solitary course to ending up being one, with some individuals beginning in financial or insurance coverage, while others begin in bookkeeping. A four-year degree supplies a solid structure for careers in investments, budgeting, and customer solutions.

A Biased View of Clark Wealth Partners

Common instances include the FINRA Series 7 and Series 65 tests for safety and securities, or a state-issued insurance coverage certificate for offering life or medical insurance. While credentials may not be lawfully needed for all preparing roles, companies and clients commonly see them as a criteria of professionalism and trust. We look at optional credentials in the next area.

The majority of economic coordinators have 1-3 years of experience and experience with monetary items, compliance criteria, and click here now direct client communication. A solid instructional background is crucial, yet experience shows the ability to apply theory in real-world settings. Some programs integrate both, permitting you to finish coursework while earning monitored hours through internships and practicums.

The Ultimate Guide To Clark Wealth Partners

Many enter the field after functioning in banking, accounting, or insurance coverage, and the transition calls for perseverance, networking, and usually sophisticated qualifications. Early years can bring long hours, stress to construct a customer base, and the need to continually confirm your know-how. Still, the job provides strong lasting potential. Financial organizers appreciate the possibility to work carefully with clients, overview essential life choices, and frequently accomplish versatility in schedules or self-employment.

They invested much less time on the client-facing side of the sector. Virtually all monetary supervisors hold a bachelor's level, and lots of have an MBA or similar graduate degree.

Clark Wealth Partners Things To Know Before You Get This

Optional qualifications, such as the CFP, typically call for extra coursework and screening, which can expand the timeline by a pair of years. According to the Bureau of Labor Data, personal economic experts make an average yearly annual income of $102,140, with top earners making over $239,000.

In other districts, there are laws that need them to meet certain demands to make use of the financial advisor or financial organizer titles (financial company st louis). What establishes some financial experts besides others are education, training, experience and certifications. There are several classifications for monetary advisors. For monetary planners, there are 3 common designations: Qualified, Personal and Registered Financial Planner.

The Facts About Clark Wealth Partners Uncovered

Where to discover a monetary advisor will depend on the type of recommendations you require. These establishments have team that might aid you understand and purchase particular types of financial investments.